Course Details

Home / Public Courses / Course Details

Modelling & Managing Uncertainty in the Subsurface (PBM48)

13-17 October 2024 5 days Doha, QatarCourse Fee: 5350 USD

Computer Fee: 350 USD

Description

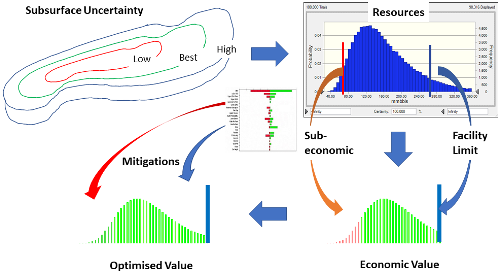

The course introduces probabilistic and deterministic approaches, their benefits and shortcomings, as applied to project approval, appraisal, reservoir surveillance and production forecasting. Included is the examination of the factors contributing to project uncertainty; subsurface, drilling, facilities, production, scheduling, cost and economics. The aim is to deepen the understanding of the complex and varying risks involved in delivering accurate estimates of production, reserves and value to key internal and external stakeholders and hence enhance decision making capability. Additionally, the course is orientated to building an understanding of the economic evaluation of oil and gas assets; the fundamentals of economic evaluation will be covered, including time value of money, discounting and NPV, project cash flow analysis and taxation.

COMPUTER REQUIREMENTS: MS Office, Excel

Laptops are optional for completing exercises.

Course Level: Skill

Instructor: Pete Smith

COMPUTER REQUIREMENTS: MS Office, Excel

Laptops are optional for completing exercises.

Course Level: Skill

Instructor: Pete Smith

Designed for you, if you are...

- A petroleum / reservoir /drilling engineer or geoscientist working in a multidiscipline team.

There are no formal prerequisites for the class. However, participants are expected to have a basic understanding of petroleum economics, statistics and be able to work with simple excel spreadsheet exercises.

How we build your confidence

This is a five-day classroom-based course with lectures supported and illustrated by worked examples, case studies and hands-on exercises. The course includes many practical applications and group exercises to develop understanding.The benefits from attending

By the end of the course you will learn to:- Evaluate uncertainties for projects at different stages of the E&P lifecycle.

- Formulate problems probabilistically and systematically assess risks & uncertainties.

- Develop decision trees to lay-out the logic of the decision, evaluate the robustness of the decision and competently use the provided software.

- Understand the basics principles of petroleum economic analysis such as the time value of money, discounting and other project cash flow measures.

- Validate data using statistical distributions and combine them using both parametric and Monte- Carlo methods.

- Evaluate forecasts and present them effectively including the correlation between variables.

- Select the key variables in a probabilistic evaluation and manage certainty by acquiring additional data (appraisal) or design of interventions (contingency).

- Conduct probabilistic project scheduling and production forecasting so that a greater awareness of the critical factors to delivery become apparent.

- Integrate risk and uncertainty into key performance indicators.

- Select the key variables in a probabilistic evaluation and manage certainty by acquiring additional data (appraisal) or design of interventions (contingency).

- Conduct probabilistic project scheduling and production forecasting so that a greater awareness of the critical factors to delivery become apparent.

- Integrate risk and uncertainty into key economic performance indicators.

Topics

- Introduction

- Risk and uncertainty fundamentals, definitions

- Bayesian Revision - Value of additional data

- Estimating probabilities and ranges - Improving estimates by calibration

- Finding a deterministic value that represents a distribution.

- Combining distributions - Monte-Carlo Method - Impact of portfolio choices

- Heuristics of probability estimation - Ground rules for estimation

- Correlations and dependent variables - How best to incorporate them.

- Influence diagrams and the Boston Squares to identify key risks.

- Importance - The variables to focus upon

- The value of information - Value of study, cost of delay, opportunity cost.

- The concept of value

- Analysis of the tools required to evaluate the worth of a business opportunity.

- Basic process of economic evaluation, inflation, time value of money, nominal & effective interest rates, discounted cash flow, net present value (NPV), internal rate of return (IRR), profitability index (PI), cumulative net cash-flow

- The value of intervention

- Intervention planning and flexibility

- Production forecasting

- How to improve the process by learning - Train wrecks

- Resource assessment - Categorisation and classification of petroleum resources

- Risk management

- Cost uncertainty

- Schedule uncertainty and critical path

Related Courses

Customer Feedback

"All topics are really important." - Reservoir Engineer at Qatar Energy"The practical exercises applied ot oil and gas industry." - Snr. Reservoir Engineer at Qatar Energy

"I liked the experience of the instructor." - Reservoir Engineer at Qatar Energy

© All rights reserved

HOT Engineering GmbH Tel: +43 3842 43 0 53-0 Fax +43 3842 43 0 53-1 hot@hoteng.com